DSCR Loan Features

Based on Property Cash Flow

Minimal Personal Financial Documentation

Since approval is based on the property’s income, lenders may require less personal financial paperwork, streamlining the application process.

Greater Flexibility for Investors

These loans provide more freedom for investors to buy or refinance rental properties without being restricted by traditional lending requirements.

Faster Approval Process

Because the focus is on property revenue rather than the borrower’s personal finances, DSCR loans can often be approved more quickly than conventional mortgages.

Easier Accessibility

Since personal income is not a deciding factor, DSCR loans are accessible to both new and experienced investors.

Cash-Out Refinance Options

Refinance existing rental properties to cover expenses like renovations, maintenance, future investments, or to recoup initial investment.

No Cap on Property Ownership

Borrowers can finance multiple properties at once, allowing them to scale their real estate portfolios without traditional lending restrictions.

Applicable to All Rental Types

DSCR loans can be used for short-term, long-term, single-family, multi-family, and even rural rental properties.

LLC Borrowing Options

Investors can structure DSCR loans under an LLC to protect personal assets and avoid personal credit reporting.

Pre-Qualify for a DSCR Loan

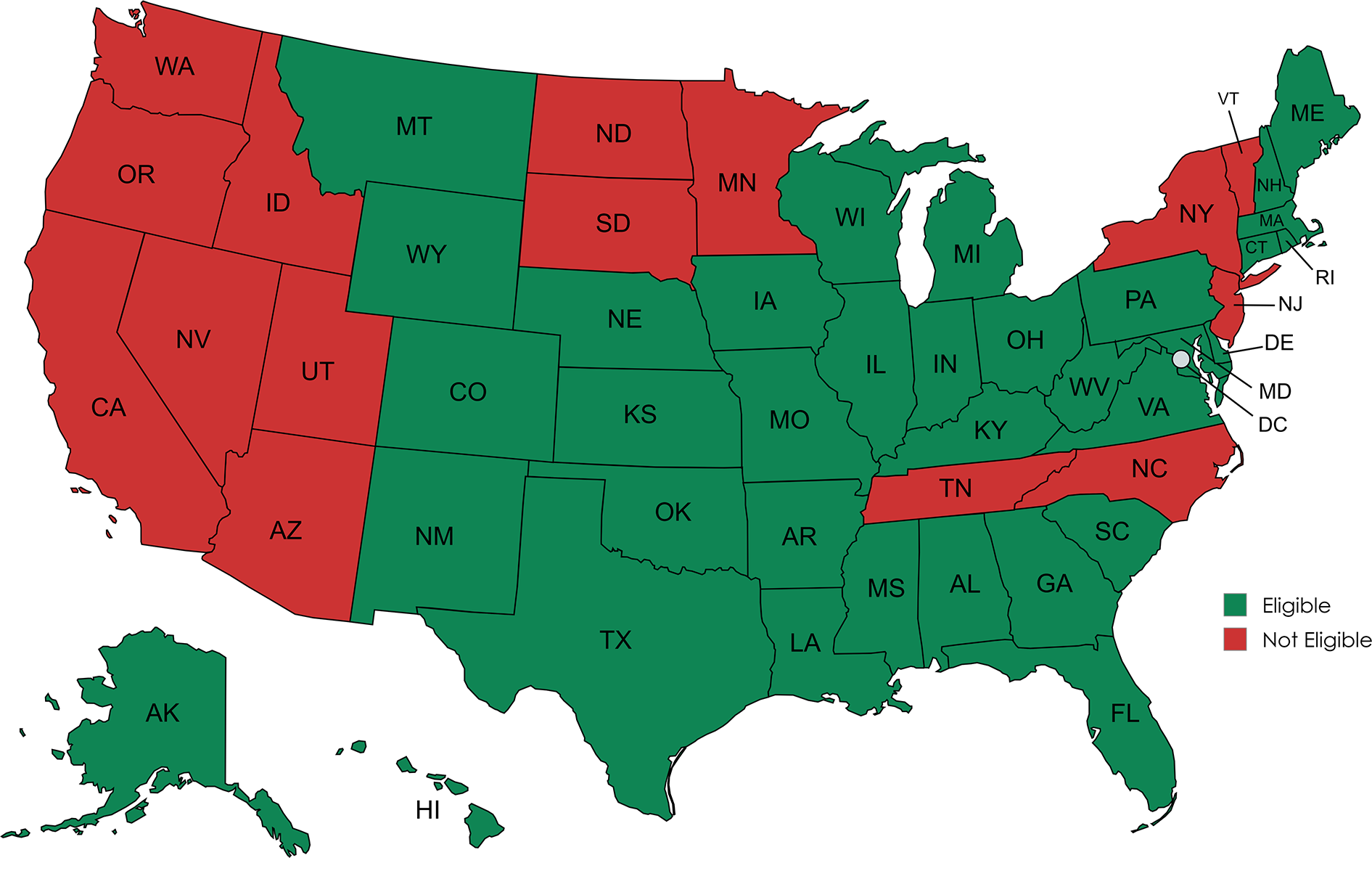

Eligible to Lend in 35 States